Term insurance necessary, know its advantages and disadvantages

These days, an ad on television is growing rapidly. In this ed, Bollywood actor Akshay Kumar looks like the benefits of term insurance by becoming a Yamraj. Generally, people make the mistake of treating insured as Term Insurance, but there is a fundamental difference between these two. We are giving detailed information to you through this news that what is the term insurance and what are its benefits.

First of all, know how many types of life insurance policies are.

Term Insurance (purely insured)

Endowment Policy (Savings Based Policy)

Money Back Policy (Savings Based Policy)

Unit Linked Insurance Plan (ULIP)

What is term insurance policy?

As we mentioned above, Term Plan is the most pure form of insurance policy. The simplest way to get life insurance is term insurance. In this, the person taking the insurer pays the premium for a certain amount of time. If the insured dies during a fixed period, then Sum Assured or a lump sum amount is given to his family or nominee. After giving a nominal premium every year in the Term Plan, cover is provided to you for a few specific years. Typically the term policy is taken for 10 years, 15 years, 20 years, 25 years and 30 years.

Understand with example:

If you have purchased term insurance for 55 lakh rupees for a period of 15 years. For this, you have to pay premium of 4 thousand rupees a year to the insurance company. At the same time, if the insured dies during the maturity of this policy, then your family will be given a sum of 55 lakh rupees. But if you stay healthy for 15 years, you will not get anything in return for the premium paid.

Two big advantages of term insurance plan:

If the policyholder dies during the maturity period of the policy, the full amount of cover is given to his nominee.

The premium paid under the term plan is tax-free under Section 80C of the Income Tax.

Why is term insurance necessary?

The Term Insurance keeps the family safe from the financial crisis even after the head of the family dies. The head of the house is the main source of income in the family. In the family, other members have to face difficulties after being disabled by the death or serious illness of that person. In such a situation, if the term insurance of sufficient amount has been taken, there is no effect on the financial health of the family. They also support regular income. Under Term Insurance, things like severe illness, accidental death and permanent illness occur. Many companies also give family members the option of regular income in term insurance.

Best Term Insurance Plans

Now let us shortlist the Top 5 Best Term Insurance Plans in India 2018. How I selected the Top 5 Best Term Insurance Plans in India 2018?

# How old are the companies

# Claim Settlement Ratio

# Premium Cost

# Plan Features.

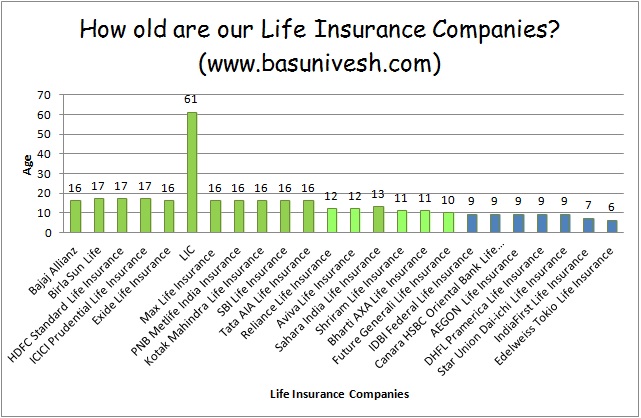

How old are our Life Insurance Companies?

Below is the chart which explains the age of all life insurance companies. I am comfortable with the company which is at least 10 years old.

You notice that among 24 Life Insurance Companies, only 17 companies completed 10 years or more. Therefore, my target is among these 17 companies only.

The reason behind this criteria is that Life Insurance is a long-term contract between you and insurance company. Hence, the older the company the more comfortable I feel.

5 Best Term Insurance Plans in India

- LIC e-Term Insurance Plan. LIC has claim settlement ratio of 98% which is the highest percentage among all the other insurance providers. …

- ICICI Pru iProtect Smart. …

- SBI Smart Shield. …

- HDFC Click 2 Protect Plus. …

- Max Online Term Plan Plus.

zurich term insurance

Zurich Term Life Insurance provides a cost-effective worldwide protection for individuals and businesses in UAE.

It is designed to pay an agreed cash lump-sum if you die during the fixed term of the policy.

In addition to the life cover, Zurich Term Life Insurance also provides the following optional benefits;

zander term insurance

At Zander, our primary reason for offering Term Life insurance is that it provides the most affordable option for people to purchase the life insurance they need. First and foremost, life insurance is for protection and having the right amount of coverage is the most imperative goal. Significantly higher cost Cash Value plans not only reduce money available for other financial priorities but limit the amount of coverage a family can afford . . . defeating the whole purpose of protection.

Zurich Insurance Group Ltd. is a Swiss insurance company, commonly known as Zurich, headquartered in Zürich, Switzerland. The company is Switzerland’s largest insurer.As of 2017, the group is the world’s 91st largest public company according to Forbes’ Global 2000s list, and in 2011 it ranked 94th in Interbrand’s top100 brands.

Zurich is a global insurance company which is organized into three core business segments: General Insurance, Global Life and Farmers. Zurich employs almost 54,000 people serving customers in more than 170 countries and territories around the globe.The company is listed on the SIX Swiss Exchange. As of 2012 it had shareholders’ equity of $34.494 billion.